There was a lot of talk and predictions a few months ago about how the Auckland property market will crash due to COVID-19. The media scaremongering and opinions of some economists were proved wrong, when in the months following, Auckland house prices and sales remained strong. This has left many people wondering why? When the ‘experts’ were so sure of a housing crash, like what was seen with the last recession with the 2007 Global Financial Crisis (GFC). Here’s why I’m confident, as history has shown, that now is as good a time as any to invest in the Auckland property market.

This is not the GFC

This is not the GFC, this is a pandemic in the year 2020. Lessons will be learned through this current crisis and changes will be made to prevent such disruption from viral outbreaks again. As was with the GFC, large reforms were conducted in response to the poor system in place at the time to protect most Kiwi’s financial security, their homes.

Prior to the GFC, there were no LVR restrictions, income verification and other tools that are now in place to protect borrowers. There were many lenders approving 100% loans, banks not verifying the incomes declared on applications, and not adequately testing whether their borrowers would be able to service their loans if conditions changed, like the increasing interest rates of the time.

In recent years, it’s been much harder to get a mortgage, with borrowers having to meet strict criteria to be approved. Which may be frustrating to some, but ultimately these requirements have been put in place to protect you.

If approved, lenders are satisfied that you will be able to service your mortgage even if unexpected circumstances arise, such as lost income, sudden unforeseen costs, increased interest rates etc.

The impact of the GFC was not as severe as predicted

“House values will decrease 30-40%”… sound familiar? These statements we’re seeing today are the same as the statements made during the GFC, however the actual effect was not as severe, with Central Auckland house prices averaging 5% drop. Yes, it’s still a drop, but if you’re able to ride through the wave and hold on to your assets, then you won’t be impacted by it.

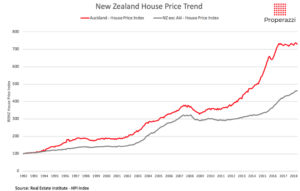

Check out this graph below, history has shown us that in spite of the ups and downs of any market, property in Auckland has continued to double in value every ten years, on average.

I have always trusted my gut instincts and held on to my properties, even though there were ‘experts’ who told me I should sell them! Look at what’s happened over the last 13 years, imagine if I had abandoned the ship when I was told I should in 2013…

The Government can’t allow a housing crash

The Government is doing what they can to protect Kiwis, understanding that most Kiwi’s financial security and future is tied up in their homes. If the property market is allowed to crash, the country will have a serious economic problem, arguably bigger than the impact COVID-19 crisis is currently having.

I’ve already seen many adjustments in the finance sector taking place to keep the housing market supported and indications that the RBNZ are prepared and confident, so I’m confident that the Auckland property market will continue to trend the way it has for decades.

In fact, now is the best time to buy or invest if you are financially and mentally ready. Always focus on your own goals.

If you’re interested in more information about the above, I go into more detail about the lessons learned from the GFC at my 1-day property investment workshop ‘How to buy or invest in Auckland property’, make sure you’re at the next one, space is strictly limited!