04 Aug Buying a second home using equity (without a deposit)

Buying a second home using equity

If you purchased your home a few years ago you’re probably excited by how much it’s worth now, but wonder, what’s next? If you sell, you still have to buy in the same market and might not be much better off without increasing your mortgage payments.

So, how do you tap into your wealth, reduce your mortgage cost and generate some more income? Property investment.

It’s daunting buying your home, whether it’s your first or you’ve sold and bought your next, it’s a big decision. However, buying an investment property isn’t anywhere near as daunting or as difficult as it seems. Here is how you can tap into your property’s equity to purchase your first investment property.

Unlock your property’s equity:

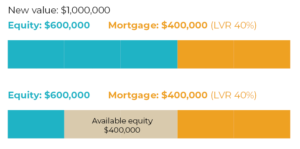

If you bought your property a few years ago for $500,000 with a 20% deposit, you would have existing lending of approximately $400,000.

If that property now is worth $1,000,000, you would have $600,000 equity in that property now.

Under current lending rules, you could borrow up to 80% (LVR 80%) of your owner-occupied property’s value, which means you have available equity of $400,000.

Purchasing your next property:

At the time of this article, the Reserve Bank of New Zealand have in place a rule that an investment property requires a 40% deposit (LVR 60%). Which means you can take the $400,000 in your owner occupied home and use this as your deposit for buying a second home using equity, with a purchase price of up to $1,000,000.

So, if you purchased a second property at $1,000,000, your property portfolio would now look like this:

Your equity has remained the same, but your portfolio has doubled in size. As you probably know by now if you regularly read my blog posts, property prices on average double every ten years (and lately in some areas, more like every five!) imagine the capital gain/equity increase you’ll see with two properties instead of just one.

Isn’t the goal to be mortgage free though?

You might be wondering how you can actually afford a larger mortgage to buy a second property. Most people tell you to pay down your mortgage, not add to it, but you can do both! By buying a second home using equity you can achieve this.

Property investment increases your income

Supporting your mortgage application

When purchasing your investment property, since your intent is to rent it out, the bank can use the income from the rent you would receive from the new property, towards your mortgage application. When you consider that the average rent in Auckland is approximately $600 per week, that’s nearly the same income as a full-time minimum wage job.

Like house prices, rent increases

Like house prices, rent on average doubles every ten years, so while your property increases in value, your mortgage stays consistent or reduces and your income increases. Imagine what you would have in passive income when you retire with just one investment property…

The rent will cover your mortgage costs

When you purchase an investment property, you have the potential to pay interest only for your mortgage payment for the lending against that property, when using this option, depending on your rental income, you can actually reduce your own payment towards your existing ‘owner occupied’ mortgage, eg:

Owner occupied mortgage = $800,000

Weekly repayment (principal and interest at 2.5%) = $729

Investment property mortgage = $600,000

Weekly repayment (interest only at 2.5%) = $288

Total mortgage repayment: $729 + $288 = $1,017

Your mortgage payment after rental income $1,017 – $600 = $417

That’s only $53 more per week compared to only keeping your original property ($400,000 weekly mortgage repayment = $364).

Would you pay a $53 subscription to have $1,000,000, an increasing income and retirement plan?

–

If you want to learn more about buying a second home using equity, property investment and how be ‘mortgage free’ by growing your portfolio, come along to my next workshop! Click here to find out more

Check out my video on this topic here:

Lucia Xiao | support@luciaxiao.co.nz