30 May 5% Deposit Home Loans – How to Buy a Million dollar house

5% Deposit Home Loans

Last week, as a part of Budget 2022, the government announced updates on homeownership products, including just 5% deposit home loans as well as changes to the First Home Grant and First Home Loan administered by Kāinga Ora. Due to the significant price jump over the past few years, especially in 2021, the aim is to support first home buyers whose needs are not being met by the current housing market.

House Price Caps Removed on Kāinga Ora First Home Loan

Currently, lenders require a minimum 20% deposit in most situations. First Home Loan as a part of Kāinga Ora Home Ownership Products is designed to help more first home Kiwi buyers on to the property ladder, which could get people into their first home with just a 5% deposit. Previously, to be eligible for 5% deposit home loan, there were restrictions on house prices, however, the house price caps for new and existing properties have been removed from the Government’s First Home Loan scheme. The changes will take effect on June 1, 2022.

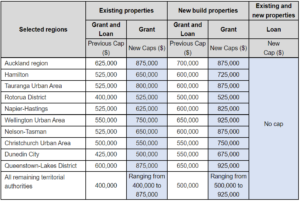

House Price Caps increased on First Home Loan Grant Programme

First Home Grant’s house price caps have been increased throughout most regions, Auckland and Tauranga will rise to $875,000, Wellington ($650,000 to $925,000), Christchurch ($550,000 to $750,000), Hamilton ($600,000 to $725,000). The updated price caps for the First home Grant have been in effect since May 19, 2022.

Check your eligibility for First Home Grant

Initially, the First Home grant scheme was introduced in 2015 by the National Government by giving a $5000 grant or $10,000 grant to help more Kiwis achieve their home ownership. If you are planning to apply for the First Home Grant you must meet Income, Kiwisaver contribution, Deposit, and property requirements. Please check your eligibility through Kāinga Ora Home and Communities for more information.

Check your eligibility for 5% deposit home loan

A First Home Loan will make entry into the current property market much easier for aspiring first-time buyers with low deposits, which could get people into their first home with just a 5% deposit. However, to be eligible for a 5% deposit home loan, applicants must meet certain criteria, including an income cap and specific lending criteria of the participating lender you choose.

Income cap:

- Individual annual income with less than $95,000 (before tax); or less than $150,000 (before tax) for a particular buyer with one or more dependents

- Joint income less than $150,000 (before tax) for two or more buyers, regardless of the number of dependents

First Home Buyers or Previous home owners:

- Plan to live in the property, the loan is not eligible for a rental or investment property

- Previous home owners in a similar financial position to a typical first home buyer

Minimum Deposit:

- a minimum 5% of the purchase price of the property you are wishing to buy

Example:

If a couple without kids total income is $150,000, they can potentially borrow 1.035 million plus 5% deposit. They can potentially purchase a 1.089 million property.

Ultimately, the Budget 2022 update on home ownership products will benefit approximately 7000 additional first home grants and 2500 extra first home loans.

Several participating lenders allow applicants to build their new houses with a First Home Loan all well. Check your eligibility and what criteria are with your preferred lender. Make the 5% deposit home loan work for you.

Please note the First Home Loan product will only be offered by particular banks. If you want to get personalised financial mortgage advice, we are here to help. We are happy to give you a free mortgage review based on your situation and provide a tailored solution.

We are looking forward to hearing from you soon!