11 Nov Top 3 reasons why the Auckland property market will continue to fly

Auckland property market

Ever since the first lockdown, when I ran my first webinar, I have been asking people not to hold back and continue to buy their own home or invest in property and if they weren’t ready, to get ready asap. I was confident then, as I am now, that prices will continue to rise. So sure, that while economists, property associations and the like were predicting crashes and advising people to wait for ‘bargains’, I was expanding my businesses both in property mentoring and mortgage finance and employing new staff every week.

It’s unfortunate and sad to see so many people who’ve come to me, absolutely regretting their decision to wait for the crash that didn’t come.

Why am I so sure there’s no impending crash?

Here are three reasons why I believe Auckland property market will continue to fly:

Quantitative Easing

In March this year, Reserve Bank of New Zealand Governor, Adrian Orr said that he would keep the OCR at 0.25% for 12 months and that he would definitely be sticking to it. RBNZ have stuck to this statement, even after the RBA (Reserve bank of Australia) dropped the rate to 0.1% on 4th November. I personally think RBNZ will reduce OCR to match RBA, it is just the matter of time.

However, RBNZ are pulling other levers to continue to stimulate the economy. In August, it boosted its quantitative easing program.

Quantitative easing is RBNZ’s money printing programme, it’s limit of $60 billion was raised to $100 billion with the intent to encourage spending primarily through pushing down interest rates.

In addition to this, just yesterday (11 November) RBNZ announced that a Funding for Lending Programme (FLP) to give banks cheap lending based on the current OCR will start in December. RBNZ have made it very clear that they want to see plenty of cash in the market, the market confidence is their priority.

Although the market is calling for LVR restrictions, RBNZ are keeping this up their sleeve as the market is finally showing the confidence they’ve been waiting for, so will give it some time to allow the cash to continue to flow. LVR’s are likely to take a few months to come.

Immigration

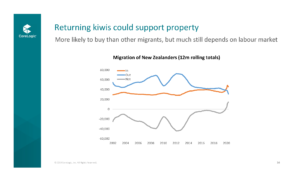

Net migration is still strong when comparing to the same time last year, young skilled kiwis are unable to go overseas for working holidays and many Kiwis are returning home after New Zealand’s success with keeping COVID-19 under control, compared to other countries. This means supply is still low and demand in the Auckland property market is high.

The country’s biggest landlord

Since Labour’s re-election, the country’s biggest landlord, Housing NZ have continued to actively buy up property. I was even approached by them a couple of weeks ago, they wanted to purchase two of my investment properties.

This just adds fuel to the fire in terms of house prices, it’s definitely still a sellers’ market… with no crash in sight.

So, is it too late?

It’s never too late to get into the Auckland property market, but it’s silly to wait. If you’re not yet in the market, saving that deposit is just going to get harder and harder.

Mindset is key to success, it’s the first thing I work on with my mentees and members. The biggest hurdle most people face, whether you’re a first home buyer or property investor, is mindset and overcoming fear. Putting all your savings on the line and having a mortgage can seem scary, which is completely understandable, buying a home is one of the biggest purchases in one’s life. However, a mortgage can be a powerful tool to help you get to financial freedom sooner than you think is possible.

Check out my video below where I discuss mindset and how to overcome fear, live from courage and show you how mortgage is not just ‘debt’ but an investment.