Will interest rates rise?

There’s been a lot of talk in the media recently about interest rates rising soon, causing fear of a housing market crash and people stuck with negative equity.

This is just fearmongering.

Here’s why you shouldn’t worry about interest rates and why they’re likely to remain low for a while yet.

Banks are testing you at a 6% interest rate

As part of bank lending policy and being responsible lenders, when applying for a mortgage, banks are testing your servicing ability on a rate that is much higher than real current interest rates. These vary from bank to bank, but the test rates hover around 6%.

If you get an approval to borrow $1m, this is your maximum based on paying 6% interest. Not the 2.29% rates we’re seeing at the moment. That’s a difference of almost $500 per week (principle and interest)!

So, if rates did rise more than double the current rate, theoretically you should still be able to afford it.

We’re not out of the woods yet

It’s been widely talked about that the Official Cash Rate (OCR), set by the Reserve Bank of New Zealand (RBNZ), will remain low for quite a few years to come. Although the property market may be booming, our economy is still in recovery with the impacts of COVID-19. RBNZ’s role is to keep inflation between 1-3% but the property market sits outside of this measure. With the OCR remaining low, interest rates will remain low.

It won’t happen overnight

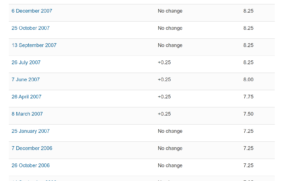

If interest rates start to climb, it won’t happen overnight. There will be signals as to when interest rates start to rise, as mentioned above the OCR is the biggest driver in changes to interest rates, it is reviewed 7 times per year. If the OCR changes, it’s not likely to increase so much that the interest rates will hike dramatically overnight. Even back before the GFC, when the OCR was rising, it only changed 1% over a year:

(OCR decisions – https://www.rbnz.govt.nz/monetary-policy/official-cash-rate-decisions)

Interest rates are like petrol prices

Rises and falls in petrol prices doesn’t stop you from driving your car, it’s something that you’re used to and understand it’s something out of your control. What is in your control is the car itself, the car you choose and how you look after it. With property, interest rates rise and fall and it shouldn’t stop you from buying a house, the important thing is buying the right one.

The right property will mean the interest rate becomes virtually irrelevant. Find out how in my next workshop – click here to find out more.

You can also check out my latest Property | Finance Helpline video, where I talk about this subject and more, make sure you tune in next Monday on Facebook for another Q&A with me:

Lucia Xiao | support@luciaxiao.co.nz