First home buyers and home owners are property investors. It is more than the ability to decorate or renovate the place you live without the landlord’s approval or security in not being told to move out; it is investing in your future.

The current boom in New Zealand property is proof that despite the fear of COVID’s impact on the economy etc, it is still a smart investment if done right.

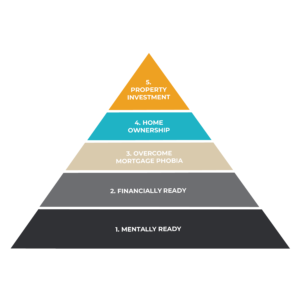

Here I’ll break down what you need to do to get into the property market and how to make the right choices for a smart property investment, using just a snippet of the five steps that I teach my mentees.

Step 1: Mindset

Buying your first home can feel like a scary and massive commitment, but when you think about it, almost everything is, until you do it. Once you get past the fear, you realise that the worst case scenario, is just one of the maaaany scenarios that can happen. If you’re prepared and confident through understanding your position, you can take that leap and break through that mindset barrier.

Step 2: Get Financially Ready

Understanding your financial situation and its effect on your borrowing ability is key to realising your financial potential. That regular Friday night out could be the difference of tens of thousands of borrowing ability. Cleaning up your spending in preparation for your mortgage application will give you the best chance to secure the finance to purchase the best property for your best potential budget.

- Good Debt vs Bad Debt

Credit cards, personal loans and hire purchases are all examples of bad debt, these aren’t ‘investments’ that will bring you a return, hold or increase in value. When a student loan is an investment into your future is a good debt by comparison. Work on reducing or eliminating the bad debts. Even if you have a credit card you don’t use, banks still view these as potential bad debts, so do affect your borrowing ability. If you don’t use it, get rid of it.

- Your regular expenses and lifestyle

Read through your bank statements and understand your spending habits, a daily morning coffee could be adding an additional $140 to your food spend per month (that’s equivalent to paying a mortgage of about $35k with current interest rates) . Although banks have benchmark living costs when calculating your borrowing ability, if you regularly spend more than this, it will be factored into your application. You should be aiming to save 50% of your income, to quickly build up your deposit and show your ability to service a loan.

Step 3: Overcome Mortgage Phobia

Too many kiwis are more comfortable with car loans and credit cards than a mortgage. The idea that you could owe hundreds of thousands or even millions of dollars in debt is enough for people to just carry on paying rent, feeling they are more free by doing so. In reality, renters become slaves to their landlord’s mortgage and will never reduce their cost to have a roof over their head, compared to a mortgage ‘investment’.

“But my rent is cheaper than a mortgage” is a surprisingly common response. If you’re flatting and are daunted by the idea that a mortgage payment of $800 per week is too expensive compared to your $250 for your room. Think about if you owned the house and were still flatting, if you live with 3 others paying $250 per room, you’d only be paying $50. So, what’s actually cheaper?

Step 4: Home Ownership

Ok, so you’ve been saving, understanding your financial position and getting yourself mentally ready for homeownership, but how do you buy your first home?

Deposit

Deposit requirements can vary, typically you’ll need 20% for an owner occupied home. Currently the lenders are able to support up to 90% lending for their existing clients if they are buying their first homes. First home buyers can have the ability to go as low as only 5% but under strict rules. Deposit requirements can be a lot higher on certain types of builds like apartments, where you’ll most likely need 50% with small floor area or sometimes banks won’t lend a cent. Apartments may seem cheaper to purchase but when you factor in the amount you need for the deposit, vs what you’re buying you’re probably better off looking at something else.

What counts as a deposit?

First home buyers have a few options to help them.

- KiwiSaver – If you’ve been contributing to KiwiSaver you can withdraw all (but $500) from your account to use towards your first home.

- Welcome Home Loan – this allows you to have a deposit as low as 5%. However, there is an income cap and a house price cap.

- First Home Buyers Grant – If you buy an existing home, you can get a grant of $1,000 for each of the 3 (or more) years you’ve paid into the scheme. The most you can get is $5,000 for 5 or more years for each person (double this if you’re purchasing a new home).

However, if you have strong incomes and a decent deposit, I would suggest not focusing on the First Home Buyers Grant or the Welcome Home Loan, as you severely limit your opportunities, particularly in Auckland and when you consider that house prices on average double every ten years, borrowing as much as you can afford for your first home is more likely to put you in a better position straight away.

Finding the right property

Your first home is probably not going to be your last. So, remove some of the wish list items that may be unachievable in your budget, try to keep emotion out of the equation and look for properties that will be the smartest choice. Do your homework:

- Research neighbourhoods

What are the recent sales prices? Are they going up in value? What is the demographic? Is there good public transport or proximity to business centres (for employment)? Understanding this can help you gage whether the area you’re looking to is going to is a worthy investment. - Does the property have room for improvement?

Finding a property that you can add value to is the best way to quickly add value so that you can progress up the ladder and improve your financial position faster. Can you add another bedroom? Are there minor improvements that can be made to make it more appealing? Look past the old, the bad taste and the dirty and see the bones and potential the property has.

Purchasing

You’ve found a good option and you’re ready to purchase, now what?

The Sale: There are many types of sales types, most common are typically ‘Auction’ or ‘Price by Negotiation’:

- Auction – A property auction is pretty much like bidding on a Trade Me auction, you’ve done your homework, you know how much you prepared to pay and once you’ve won as the top bidder, you’ve committed to the sale (you’re unconditional). In property, this means that you need to have done your due diligence before you bid as there’s no getting out if it if you’ve won and you need to know that you can get finance. Most first home buyers are scared off by this, but if you know your position and the value of the property, you have just as much chance as anyone else.Typically, with Auctions you need 10% deposit to put down on the day if you win and settlement is usually one month later – however you can negotiate these terms before you go to auction. Ask the agent for “Variation form”.

- Price by Negotiation – This sales process opens up the opportunities for conditional buyers and allows for negotiation to an agreed price, most first home buyers are more comfortable with this as they can have an escape if for example, a condition is based on a building inspection, and if the inspection reveals a problem, you have the opportunity to negotiate or walk away. However, with this type of sale, you do have time limit to remove your conditions (typically 5 working days but can be negotiated) so that you go unconditional and pay your deposit (like with an auction). However, the vendor will likely include an escape clause of their own, so that if someone comes along who is prepared to go unconditional straight away, even though you are under contract, the vendor can accept their offer and shorten your time limit to meet your conditions.

Who is involved in the process?

There are typically 4 parties involved in the purchase process:

- Mortgage broker – A good mortgage broker is your best tool to securing finance, you could go to the bank, but then you’re limited by only one option. A broker has connections and relationships with many lenders and can get you the best interest rates and the right lender for your financial position. Best of all, their services are free.

- Real estate agent – The agent will be your liaison with the vendors, don’t forget that the agent is working for the vendor, they can come across as being on your side, but their job is to get the best outcome for the vendor (highest price, quickest turn around) so will use tactics to put the pressure on you, don’t let them bully you.

- Lawyer – You’ll need a property lawyer to complete the sale. They liaise with the vendors lawyer, make sure everything is legal and complete the sale on settlement day. Don’t forget the lawyer is there to inform you all the risks there may be, but don’t let them scare you off.

- You! – You, your partner and whoever is involved in the purchase, will need to be across and connected to all of the three parties above, as there is a lot of paperwork to sign and understand.

Step 5 – Property Investment

You’ve purchased your first home and have started your property investment journey to financial freedom! The hard part is over, you’re on the ladder. Now is the time to work on your strategy to increase the value of your home so that you can keep building and investing in your future. I won’t go into this here, but I recommend you come to one of my workshops where I go into detail on all of the above and how to avoid mistakes in property investment so you can minimise your risk and accelerate your journey to becoming financially free! – CHECK IT OUT HERE

Lucia Xiao | support@luciaxiao.co.nz

Check out Lucia’s book, Financial Freedom – 5 Steps 5 Years.

Check out Lucia’s book, Financial Freedom – 5 Steps 5 Years.

Lucia is passionate about helping Kiwis realise their financial potential so she’s written a book that covers her journey from living in a state house to building a property portfolio of over $17 million and highlights her five lessons and steps to achieving financial freedom.