‘To buy or not to buy?’ is always the question everyone asks when it comes to property.

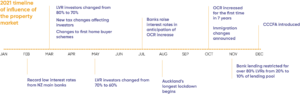

2021 was a rollercoaster for those in the market and for those wanting to be, from crazy price increases to drastic changes to finance policies impacting everyone from first home buyers to property investors.

No one could have predicted all that happened in 2021, highlighting that no one has a crystal ball to see what the property market will look like in 2022, however our message remains the same: if you’re ready to buy, now is the best time to buy (if you know what to buy).

What we think we’ll see in the market this year

Market slow down

If you’ve read the headlines over the last couple of weeks you’ll see that the property market has pretty suddenly grinded to a halt, with sales dropping away over the Christmas and New Year break.

Although we typically see a slow down in the market during this period every year, this time has been a bit more dramatic with the impact of the introduction of the Credit Contracts and Consumer Finance Act (CCCFA) on December 1, the tightening up of banks (particularly affecting first home buyers) and the perception that interest rates will continue to rise causing some hesitation and panic from some buyers and sellers.

We won’t see prices ‘fall’

With the influences contributing to this slow down, there’s opinion circulating that we’re likely to see house prices fall, we don’t believe this is likely (particularly in Auckland).

We may see some contraction in the short to mid term in certain areas of the market where people were potentially paying too much in desperate attempts to secure property. However, echoing what Lucia always reminds us, property investment is for the long haul, there are cycles within cycles of the property market but the trend over the decades is consistent.

Activity will likely pick up again

Although the CCCFA changes have only been in place for 7 weeks now, many industry leaders have been calling for a review of the Act, including a petition from John Bolton of Squirrel Money and calls from party leaders like David Seymour of Act New Zealand.

It’s pretty crazy that a one off purchase at Kmart or your regular takeaway on Friday night or cafe coffee is seen as a regular expense that you are unable to give up if you needed to (should interest rates rise to the level of approximately 6.5% that you’re already being tested for when assessed for a mortgage). It’s making it significantly harder to secure lending, when these types of purchases can impact your borrowing ability by hundreds of thousands of dollars under these new rules of the CCCFA.

With the rules in place right now, we’re seeing the effect of the drop in ability for some people to purchase. However, the Minister of Commerce and Consumer Affairs, David Clark has acknowledged the pleas and will be conducting an inquiry into the CCCFA. Which could lead to the possibility of these restrictions being eased allowing more people to be once again able to purchase.

Stay focused on your goals

Which leads to why now is a great time to buy, if you’re ready to buy and know what you’re looking for.

“You’re only buying one house, not the whole market” Lucia Xiao

With many people out of the race (for now) the competition for good property has reduced, along with an increase of listings expected over the coming months, there is greater choice. The perfect mix to pick up a ‘bargain’.

Property with clear ability to add real value will see you through any potential dips in property prices as a strategy to unlock a property’s potential means you’re not paying a premium for a finished or maximised-potential property.

Don’t be disheartened by these changes, there are always opportunities, if you’d like to learn more about the CCCFA and how to improve your borrowing ability, register now for our free webinar with FINAX Mortgage Adviser, Lillian Nguyen and Lucia Xiao, who will be offering tips to present the best mortgage application so you don’t miss this window of opportunity to secure your next property. CLICK HERE TO FIND OUT MORE