Flipping houses is not property investment

There’s a misconception that flipping houses is the same as property investment. The reality is they’re both very different strategies.

What is flipping?

There are lots of tv shows about people ‘flipping’ houses to make a ‘quick’ profit. Which has likely inspired many to purchase property with the intent to resell for a profit. These types of buyers are really called ‘Speculators’.

Most of the time these ‘flips’ are short term and typically cosmetic renovations, like replacing the kitchen and bathrooms with new ones and giving the place a lick of paint, chucking the house back on the market and hope to make a few dollars.

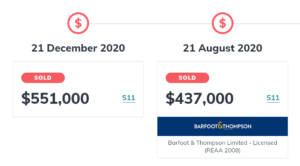

Here’s a flip of a property in Massey, a two bedroom cross lease that had a very basic refresh then resold:

Other forms of flipping are buying and holding a property for a short period in a hot market for a couple of months then resell.

It might sound like a good idea but in reality, this strategy is far more risky and more costly than property investment.

What is property investment?

Property investment is for the long haul, it’s about building wealth through asset accumulation for future financial freedom.

Property investors buy and hold property with no intent to sell, and build wealth through capital gain and rental return. Most investors, the ‘mum and dad’ investors, likely make no money for a long time, as they’re most likely to still have a mortgage which is serviced by the rental income.

Flipping vs Investment – what’s better?

Definitely investment.

There are many reasons why investing is a far better strategy than speculating. In fact, you can get all the same benefits of flipping without the risk, through property investment. Below are just a few of the reasons to keep away from ‘flipping’.

- It’s gambling

Replacing a kitchen or a bathroom doesn’t add hundreds of thousands of dollars of value, the effect of this type of renovation only adds a small difference to the real value of the home, the huge increases you see in these flipped houses is usually due to market conditions. As soon as there’s a change in the market, it can dramatically affect the return the speculator may be basing the cost of their renovation on. It’s risky and they could lose real money. - It’s more expensive

Buying and selling costs a lot of time and money, every time you flip a property you’re paying lawyers, real estate agents, stagers etc. which costs tens of thousands of dollars. On top of this, there is also a capital gains tax called the Brightline Test. If you purchase a property that is not your owner-occupied home and you sell within 10 years, you will pay a tax on the gain from when you bought it. Also, since trading property in this way is seen as a business, you would also need to pay GST. - You’re losing in the long run

Auckland property values typically double on average every ten years and money devalues with inflation. If speculators held on to their properties, they would be in a much better position financially. Every time they sell a house not only does it cost them to do it, they miss out on the opportunity to build wealth, as the cash they make devalues over time and is not working for them like it is if it is invested properly. - You can’t quit your day job

To buy property, especially in Auckland you’ll likely need a mortgage. To secure a mortgage you need to show income to support the loan, the strongest income is usually PAYE or self-employment, you can also use rental income which banks will consider typically 75%. However, for speculators who flip houses, the banks don’t consider the profits as ‘income’ so without keeping your ‘day job’ you can’t continue to purchase more houses.

Property investors with the right strategy (like mine that enabled me to walk away from my corporate income to do what I love and build a $17m portfolio in 5 years) can make the same gains on their properties in equally short time, increase their rental return and build capital allowing them to provide that ‘cash’ to purchase their next property without the need to sell and not lose thousands in the process.

Property investors aren’t so affected by changing market conditions, as the intent is not to sell, when you don’t sell, you don’t realise the loss (which is highly unlikely when you consider Auckland doubles every ten years!).

With house values increasing, inflation eradicating debt along with rental return, this winning formula is the way to build wealth to achieve financial freedom.

If you want to know how to build your portfolio quickly so you can reach financial freedom and retire early, come along to my next workshop.

Lucia Xiao | support@luciaxiao.co.nz